Investments in gemstones are not as well known as in diamonds. However, the popularity and price of gemstones have been growing rapidly in recent years. Take for example the sale of an 8.62 ct unheated Burmese ruby for $3.62 million (Christie’s, 2006).

Parameters affecting the price of gemstones

Similar to diamonds, there are quantities in gemstones that play a role in determining their price and quality.

- carat weight

- clarity

- color

- cut

- origin

- treatments

What to know about investing in gemstones?

The gemstone must weigh at least 2 ct and have a market value of over $3,000. Its rarity also plays a significant role. The buyer should always be prudent and careful. So try to follow the following advice before buying:

Seller credibility: Always check the merchant’s credibility and history. More traditional stone establishments are replacing online offers.

Knowledge: If you find out as much as possible about the stone you choose, you will reduce the risk of making a bad purchase.

Independent laboratory certificate: Only accept confirmation from reputable gemological laboratories.

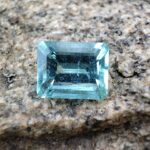

Rarity: Choose stones that are unique and rare. The top ten currently includes Burmese ruby, Kashmir blue sapphire, Colombian emerald, red spinel, tsavorite garnet, mandarin garnet, alexandrite, jadeite, imperial topaz and Paraíba tourmaline.

What to avoid?

Wherever big profits are hidden, scammers should be avoided. Only natural and untreated stones are suitable for investment.

Who will appreciate investment gemstones?

Precious stones will appeal to connoisseurs and those interested in unconventional investments. It is advantageous to invest money in them at a time when the market for real estate, bonds, mutual funds and precious metals is unstable, or when the value of the dollar fluctuates. Unlike them, a gemstone is a product of nature and is not created on demand. In addition, it carries beauty and imaginary profit.

Red spinel is one of the top ten rarest gemstones.

Why invest in these commodities?

Advantages

- Concentrated form of wealth

- Value preservation

- Shelf life

- Portability

- A timeless investment

Disadvantages

- Acquisition costs

- Speculation on price growth

- Lower liquidity

Investing may seem like a science at first glance, but there’s no need to worry. If you set reasonable goals, diversify your portfolio, and work with trusted traders, the returns can delight not only you but your descendants as well.